by | Jan 14, 2023 | Tax Tips and News

Californians have been battered by torrential rains and flooding from a recent series of storms. To help victims recover, the Internal Revenue Service recently announced tax relief for federally declared disaster areas in the state.

Which California counties are getting tax relief?

Initially published on January 10, the news release was updated yesterday to include 10 new affected areas. Now, the relief applies to 41 counties across the state:

- Alameda

- Colusa

- Contra Costa

- El Dorado

- Fresno

- Glenn

- Humboldt

- Kings

- Lake

- Los Angeles

- Madera

- Marin

- Mariposa

- Mendocino

- Merced

- Mono

- Monterey

- Napa

- Orange

- Placer

- Riverside

- Sacramento

- San Benito

- San Bernardino

- San Diego

- San Francisco

- San Joaquin

- San Luis Obispo

- San Mateo

- Santa Barbara

- Santa Clara

- Santa Cruz

- Solano

- Sonoma

- Stanislaus

- Sutter

- Tehama

- Tulare

- Ventura

- Yolo

- Yuba

Visit the IRS’s Tax Relief in Disaster Situations page for the most up-to-date list of eligible locations.

What are the terms of the California tax relief?

Tax relief generally provides qualifying individuals and businesses residing in federally declared disaster areas additional time to meet filing and payment deadlines. The California relief pushes back a number of deadlines beginning January 8, 2023, until May 15, 2023, including the following:

- January 17, 2023, quarterly estimated tax payment deadline

- January 31, 2023, quarterly payroll and excise tax filing deadline

- March 1, 2023, farmers’ filing and payment deadline (if they forgo quarterly estimated payments)

- April 18, 2023, quarterly estimated tax payment deadline

- April 18, 2023, individual income tax return filing and payment deadline

- April 30, 2023, quarterly payroll and excise tax filing deadline

This relief also extends to individuals and businesses with uninsured or unreimbursed losses resulting from the storms. Qualifying victims “can choose to claim [those losses] on either the return for the year the loss occurred (in this instance, the 2023 return normally filed next year), or the return for the prior year (2022, normally filed this tax season).”

However, when claiming uninsured or unreimbursed losses, taxpayers should review Publication 547 and remember to “write the FEMA declaration number—3691-EM—on any return claiming a loss.”

Sources: IR-2023-03; “Storms keep pummeling California, causing widespread flooding and evacuations,” NPR.org

– Story provided by TaxingSubjects.com

by | Jan 13, 2023 | Tax Tips and News

The wait is over for tax professionals eager to learn when the 2023 filing season will begin. Today, the Internal Revenue Service revealed they will start accepting and processing individual returns on January 23, 2023. The federal tax agency reassures that the service it provides this year will be improved by the recent hiring of more than 5,000 telephone and in-person staff.

This announcement caps off several busy weeks for the federal tax agency, which have included the publication of guidance related to clean vehicles, the completion of automatic corrections for the 2020 unemployment compensation exclusion, and the extension of deadlines for California storm victims.

When is Tax Day 2023?

The deadline for filing an individual return, requesting an extension, and paying tax owed is April 18, 2023 due to the Emancipation Day holiday.

How long will it take the IRS to issue tax refunds?

The IRS predicts that tax refunds generally will be issued within 21 days if the following criteria are met:

- The return is filed electronically

- The taxpayer chooses direct deposit

- The return has no issues

However, a provision in the PATH Act prevents the IRS from issuing refunds for any return claiming the Earned Income Tax Credit or Additional Child Tax Credit until February 15. This delay is designed to provide the agency with additional time to combat fraudulent tax returns.

Do I have to wait until January 23 to transmit client returns to the IRS?

Tax professionals using Drake Tax® do not have to wait until January 23 to submit completed individual client returns. Drake Software places returns received before the start of filing season in a queue and automatically transmits them to the IRS when the agency begins processing.

Source: IR-2023-05

– Story provided by TaxingSubjects.com

by | Jan 7, 2023 | Tax Tips and News

High gas prices have understandably made plug-in electric and fuel cell vehicles more attractive in recent years. While a provision in the Inflation Reduction Act of 2022 is designed to make the switch less of a financial burden, there is confusion surrounding some of the new requirements for the Clean Vehicle Credit.

Naturally, the Internal Revenue Service has been working to issue guidance for those new requirements. As part of that effort, the agency announced proposed regulations in Notice 2023-1 and updated webpages containing general information about the Clean Vehicle Credit and an index of qualified manufacturers and vehicles.

How does the Clean Vehicle Credit work for TY 2023?

The Clean Vehicle Credit can be worth up to $7,500 for qualifying EVs and FCVs purchased and put into service on or after January 1, 2023. For the purposes of the credit, “put into service” means “the date the taxpayer takes possession of the vehicle” (N 2023-1, 5).

(Note: The Clean Vehicle Credit was available for clean vehicles purchased prior to 2023, but those requirements are different.)

Like many individual tax credits, those who want to claim the Clean Vehicle Credit cannot have a modified adjusted gross income (AGI) that exceeds a specific threshold established for their filing status:

- $300,000 for married couples filing jointly

- $225,000 for heads of households

- $150,000 for all other filers

Further, qualifying vehicles have to meet a number of requirements, ranging from the location of final assembly to MSRP thresholds for specific vehicle classifications. Here is how the IRS breaks down the requirements:

- Have a battery capacity of at least 7 kilowatt hours

- Have a gross vehicle weight rating of less than 14,000 pounds

- Be made by a qualified manufacturer. See [the] index of qualified manufacturers and vehicles.

- FCVs do not need to be made by a qualified manufacturer to be eligible. See Rev. Proc. 2022-42 for more detailed guidance.

- Undergo final assembly in North America

- [MSRP doesn’t exceed] $80,000 for vans, sport utility vehicles, and pickup trucks

- [MSRP doesn’t exceed] $55,000 for other vehicles

Further, the vehicle must be purchased new, and the seller has to report all required information to the IRS at the time of sale. To ensure a vehicle meets the North America final assembly requirement, the IRS recommends using the Department of Energy VIN Decoder tool. (The rules for used vehicles are different.)

What about the mineral and battery component requirements?

Unfortunately, the notice does not explain the critical mineral and battery component percentage requirements, which are generally considered the most complicated aspect of the updated Clean Vehicle Credit. However, the agency promises that proposed regulations for those requirements are “forthcoming” (N 2023-1, 3).

Want to learn more about the Inflation Reduction Act?

Attend a Drake Software webinar exploring the Inflation Reduction Act that features Drake Software Chief Revenue Officer John Sapp, CPA; Drake Software Lead Tax Analyst Bob Nolan, CPA EA; and Drake Software Tax Software Trainer Ann Campbell, CPA CIA. Sign up for “Inflation Reduction Act: Panel Discussion” on DrakeCPE.com.

Sources: Notice 2023-1; “Manufacturers and Models of Qualified Used Clean Vehicles,” IRS.gov; “Manufacturers and Models for New Qualified Clean Vehicles Purchased in 2022 and Before,” IRS.gov; “Manufacturers and Models for New Qualified Clean Vehicles Purchased in 2023 or After,” IRS.gov; “Credits for New Clean Vehicles Purchased in 2023 or After,” IRS.gov

– Story provided by TaxingSubjects.com

by | Dec 14, 2022 | Tax Tips and News

After the 2022 tax season found the Internal Revenue Service spread thinner than ever before, the agency is taking steps to ensure that the first few months of 2023 go far more smoothly.

How is the IRS working to get ahead of staffing issues in the upcoming tax season?

In addition to creating job openings in Taxpayer Assistance Centers, the IRS has already hired more than 4,000 new customer service representatives. The IRS is pushing to hire 5,000 customer service reps in total—leaving fewer than 1,000 hires left to go.

“Our phone lines have been simply overwhelmed during the pandemic,” says IRS Commissioner Chuck Rettig, “and we have been unable to provide the help that IRS employees want to give and that the nation’s taxpayers deserve. But help is on the way for taxpayers.”

How will these IRS hires affect taxpayers and tax preparers in 2023?

In practical terms, these new customer service hires translate to improved phone communication during the tax season.

In Rettig’s words, “The IRS is fully committed to providing the best service possible, and we are moving quickly to use new funding to help taxpayers during the busy tax season. As the newly hired employees are trained and move online in 2023, we will have more assistors on the phone than any time in recent history.”

How soon will these new hires be ready for tax season?

Onboarding is underway for the new customer service representatives, including service and taxpayer experience various trainings over the course of several weeks. Hiring has been staggered, but many of these reps will be ready for action in early 2023 for tax season. The remainder will join as they complete preliminary training, and most will be actively answering phones by the time the IRS sees the highest call volumes (usually around Presidents’ Day).

How are these new positions and hires being funded?

Expansion of IRS call centers is a benefit of the Inflation Reduction Act, which was approved in August of this year. Improvement efforts do not end there: The IRS is also seeking new employees in information technology and compliance, taking a holistic approach to improving taxpayer services overall.

All that’s left now is to wait and see if these aspirations can be met. Still, the tax-filing landscape for 2023 looks promising; 4,000 new customer service hires certainly call for celebration.

Sources: IR-2022-197; IR-2022-191

– Story provided by TaxingSubjects.com

by | Dec 9, 2022 | Tax Tips and News

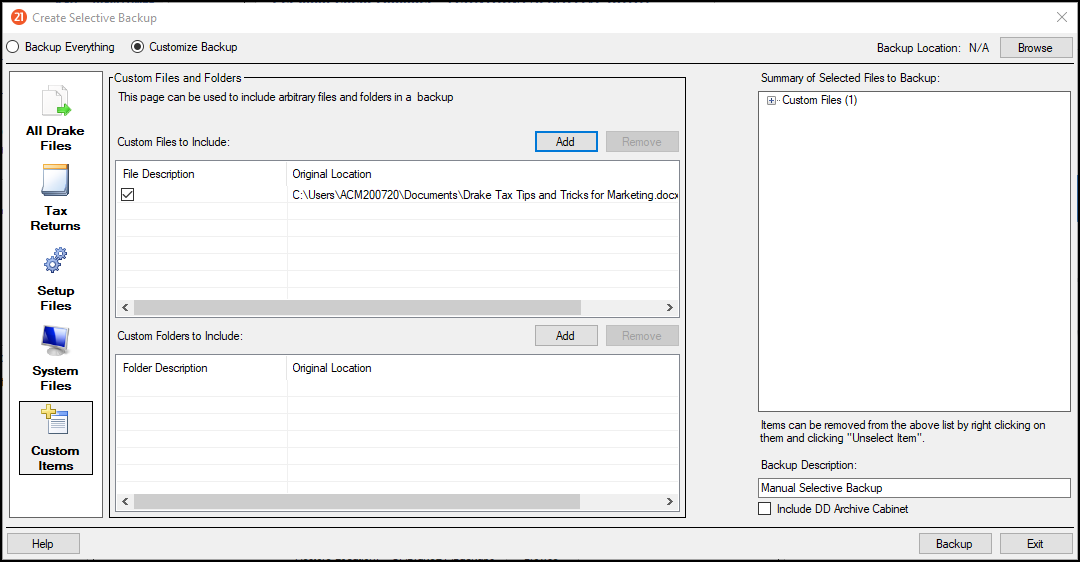

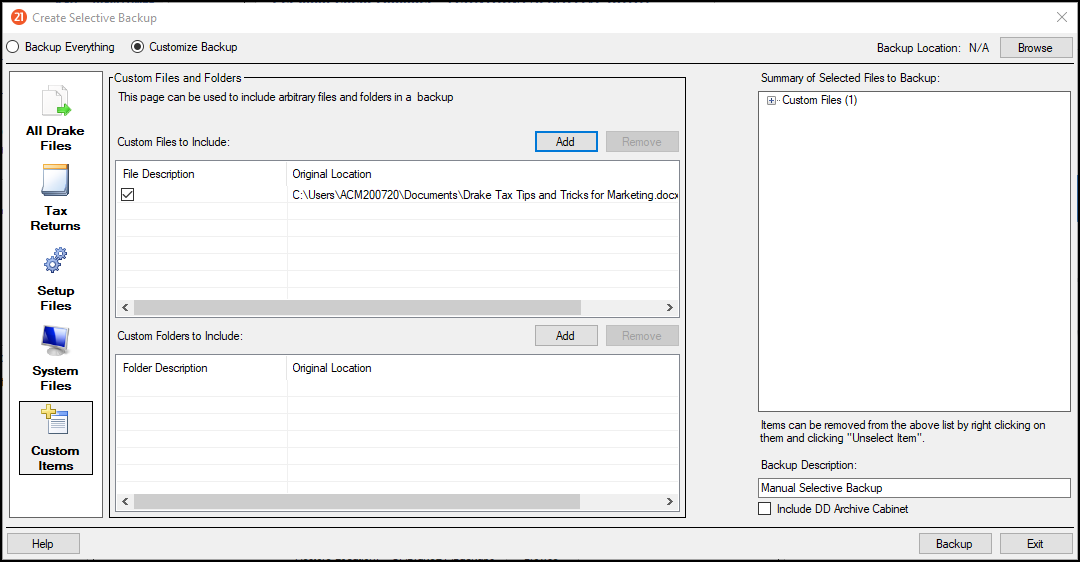

In this series, learn about a few popular Drake Tax features and navigation tools that help you save time and stay productive.

Loss of taxpayer information during the filing process due to technical difficulties is a sure way to fast-track frustration during tax season. Fortunately for Drake Tax users, today’s highlighted feature is an info life saver.

The Backup and Restore Tool at a glance

The Backup and Restore Tool does exactly what it says on the tin, and not just for tax return files: Any file can be backed up with this handy feature. You can perform manual, one-time backups or establish automatic backups to run in the background as needed.

How do I access the Backup and Restore Tool?

From the Drake Tax Home window:

- Click Tools.

- Click File Maintenance from the drop list.

- Select Backup.

The Backup and Restore window will pop up, and you can work your magic from there.

How do I make a one-time backup?

To make a one-time backup:

- Navigate to the Backup and Restore window using the instructions above.

- From the Manual One-Time Backup section of the window, choose the location where you want to back up your files.

- Click Selective Backup.

- Select Backup.

It’s that simple!

How do I make a custom backup?

To make a custom backup:

- Navigate to the Backup and Restore.

- Select Create Selective Backup.

From there, you can choose to either back up all Drake Tax files or individual ones—and these can be anything from folders to photo albums.

See how the Backup and Restore Tool saves time with a Drake Tax free trial

Ready to explore Drake Tax and the Backup and Restore Tool for yourself? Download the free trial today by clicking the button below.

– Story provided by TaxingSubjects.com

by | Nov 19, 2022 | Tax Tips and News

Don’t forget to protect your data during the holiday season (or ever)

Thanksgiving traditions are not one size fits all. Whether roasting turkey or preparing something completely different, families put their unique spin on the holiday. The Security Summit celebrates by kicking its annual National Tax Security Awareness Week on Cyber Monday, and this year marks the seventh anniversary of the event. (Their secret ingredient is practical tips for keeping taxpayer data safe.)

A collaboration between the Internal Revenue Service, state departments of revenue, and private members of the tax industry, the Security Summit has focused on helping tax professionals and taxpayers safeguard personally identifiable information (PII) since its formation in 2015. From November 28 – December 2, the Summit will share daily data security advice.

The Security Summit chooses to host its annual data security awareness event during the week of Cyber Monday, in part, to highlight the risks that tax professionals and taxpayers face during the busiest shopping season of the year. After all, identity thieves will deploy a flood of phishing scams to capitalize on the consumerism feeding frenzy. Knowing the telltale signs of scams and how to develop good cybersecurity hygiene can help protect you and your clients from identity theft.

What will the Security Summit cover during National Tax Security Awareness Week 2022?

This year, the Security Summit is sharing tips for shopping online, donating to charity, reviewing written data security plans, acquiring an Identity Protection PIN, and protecting small businesses. Here is the detailed daily itinerary shared by the IRS in a recent news release:

- Day 1 – Cyber Monday: Protect personal and financial information online

- Use security software for computers and mobile phones – and keep it updated.

- Make sure anti-virus software for computers has a feature to stop malware, and that there is a firewall enabled that can prevent intrusions.

- Use strong and unique passwords for all accounts.

- Use multi-factor authentication whenever possible.

- Shop only secure websites; look for the “https” in web addresses and the padlock icon; avoid shopping on unsecured and public Wi-Fi in places like coffee shops, malls or restaurants.

- Day 2 – Giving Tuesday: Beware of scammers using fake charities

- Individuals should never let any caller pressure them into giving a donation without allowing time for them to do some research.

- Confirm the charity is real by asking for its exact name, website and mailing address.

- Before making a donation, use the IRS Tax-Exempt Organization Search tool (TEOS) to verify it’s an IRS-recognized charity.

- Be careful about how a donation is made. After researching the charity, pay by credit card or check and not by gift card or wiring money.

- Day 3 – Tax professionals should review their security protocols

- Deploy basic security measures.

- Use multi-factor authentication to protect tax software accounts.

- Create a Virtual Private Network if working remotely.

- Create a written data security plan as required by federal law.

- Know about phishing and phone scams.

- Create data security and data theft recovery plans.

- Day 4 – Get an Identity Protection PIN

- The Identity Protection PIN or IP PIN is a six-digit code known only to the individual and the IRS. It provides another layer of protection for taxpayers’ Social Security numbers on tax returns.

- Use the Get an Identity Protection PIN (IP PIN) tool at IRS.gov/IPPIN to immediately get an IP PIN.

- Never share the IP PIN with anyone but a trusted tax provider.

- Day 5 – Businesses should watch out for tax-related scams and implement safeguards

- Learn about best security practices for small businesses.

- IRS continues protective masking of sensitive information on business transcripts.

- A Business Identity Theft Affidavit, Form 14039-B, is available for businesses to report theft to the IRS.

- Beware of various scams, especially the W-2 scam that attempts to steal employee income information.

- Check out the “Business” section on IRS’s Identity Theft Central.

The IRS also recommends tax professionals read Publication 4557, Safeguarding Taxpayer Data and Small Business Information Security: The Fundamentals. Those who are interested in sprucing up (or creating) their written information security plan (WISP) can review the sample published this year by the Security Summit.

Source: IR-2022-202

– Story provided by TaxingSubjects.com